- Email support@dumps4free.com

Topic 6: Misc. Questions

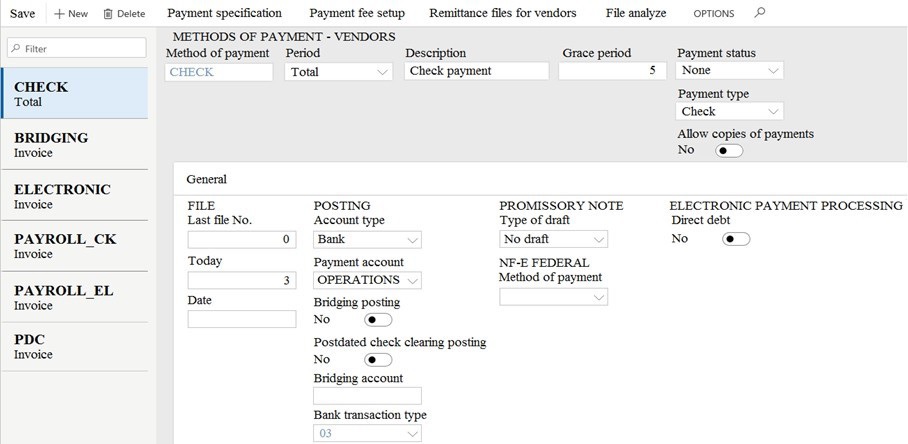

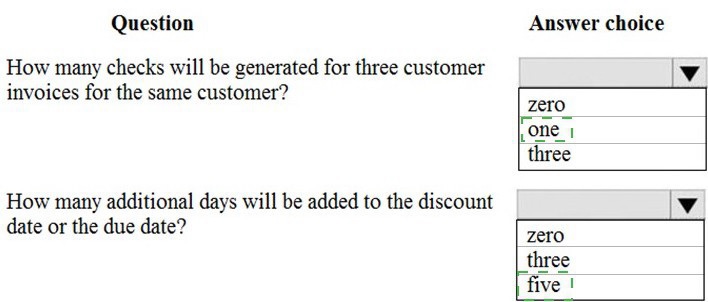

You are asked to configure the method of payments for vendors.

You are viewing an Accounts payable method of payment.

Use the drop-down menus to select the answer choice that answers each question based

on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

You are a functional consultant for Contoso Entertainment System USA (USMF).

You need to apply a constant currency exchange rate to calculate the reporting currency

value of fixed assets.

To complete this task, sign in to the Dynamics 365 portal.

Answer: See explanation below.

Explanation:

The currency Translation Type needs to be set to Current. This option uses the last rate

on or before the period specified in the report regardless of what the exchange rate was at

the time of purchase for each asset.

Navigate to General Ledger > Chart of Accounts > Accounts > Main Accounts.

Select the Financial Reporting account.

In the Reporting currency exchange rate type, select Current from the drop-down

list.

Click Save to save the changes.

Question No : 32 CORRECT TEXT - (Topic 4)

Microsoft MB-310 : Practice Test

34

D18912E1457D5D1DDCBD40AB3BF70D5D

A customer uses the sales tax functionality in Dynamics 365 Finance.

The customer reports that when a sales order is created, sales tax does not calculate on

the line.

You need to determine why sales tax is not calculated.

What are two possible reasons? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

A.

The sales tax group is populated on the line, but the item sales tax group is missing.

B.

The sales tax settlement account is not configured correctly.

C.

The sales tax authority is not set up for the correct jurisdiction.

D.

The sales tax code and item sales tax code are selected, but the sales tax group is not

associated to both

codes.

E.

The sales tax group and item sales tax group are selected, but the sales tax code is not

associated with

both groups.

The sales tax group is populated on the line, but the item sales tax group is missing.

The sales tax group and item sales tax group are selected, but the sales tax code is not

associated with

both groups.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/indirect-taxesoverview

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/tasks/set-up-salestax-

groups-itemsalestax-

groups

You are a functional consultant for Contoso Entertainment System USA (USMF).

You need to create a report that contains the sales tax settlements for the state of

California during the quarter that began on January 1, 2017. To validate you results, save

the file in Microsoft Excel format to the Downloads\Report folder.

To complete this task, sign in to the Dynamics 365 portal.

Answer: See explanation below.

Explanation:

Navigate to Tax > Declarations > Report sales tax for settlement period.

Enter the ‘From’ date.

Select the settlement period (Quarter).

Click ‘OK’.

Select Yes in the Create electronic tax document field.

Select the Downloads\Report folder and file format.

Click ‘OK’.

A company plans to create a new allocation rule for electric utilities expenses. The

allocation rule must meet the following requirements:

* Distribute overhead utility expense to each department.

* Define how and in what proportion the source amounts must be distributed on various

destination lines.

You need to configure the allocation rule. Which allocation method should you use?

A.

AFied percentage

B.

Equally

C.

Basis

D.

Fixed weight

Basis

Explanation: References:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/generalledger/

ledger-allocation-rules

| Page 7 out of 41 Pages |

| Previous |