Question # 1

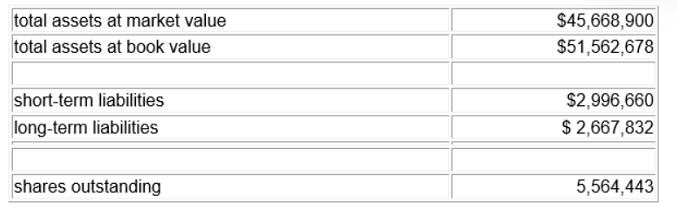

At 4:00 p.m. Eastern Time on July 6, the following information is collected for the Marigold

Canadian Dividend Fund:

What is the net asset value per unit NAVPU for the Marigold Canadian Dividend Fund for

July 6? |

| A. $7.19

| | B. $7.65

| | C. $8.25

| | D. $9.27 |

C. $8.25

Explanation: This is the net asset value per unit (NAVPU) for the Marigold Canadian

Dividend Fund for July 6. The NAVPU is calculated by dividing the net asset value (NAV) of

the fund by the number of units outstanding. In this case, the NAVPU is $8.25

($45,668,900 / 5,564,443).

The NAV is the value of a fund’s assets minus the value of its liabilities. The value of assets

is the value of all the securities in the portfolio, plus any cash and cash equivalents, plus

any accrued income for the day. The value of liabilities is the value of all short-term and

long-term liabilities, plus any accrued expenses for the day. The NAV is usually expressed

on a per-share or per-unit basis, which is the NAVPU.

The NAVPU is the price at which investors can buy or sell units of the fund. It is determined

at the end of each trading day based on the closing market prices of the portfolio’s

securities. The NAVPU can change daily depending on the performance of the securities in

the fund and the fund’s expenses.

Question # 2

| Which of the following statements about standard deviation is CORRECT? |

| A. Indicates how much an investment's performance fluctuates around its average

historical return. | | B. A standard deviation greater than one indicates a higher level of volatility than the

market. | | C. Measures the systematic risk of an investment relative to a benchmark index. | | D. Standard deviation is also referred to as beta. |

A. Indicates how much an investment's performance fluctuates around its average

historical return.

Explanation: The correct answer is A. Indicates how much an investment’s performance

fluctuates around its average historical return.

Standard deviation is a measure of how spread out the data points are from the mean

value. It is calculated as the square root of the variance, which is the average of the

squared differences from the mean. Standard deviation can be used to assess the volatility

or risk of an investment by showing how much the returns deviate from the expected or

average return. A higher standard deviation means that the investment has a wider range

of possible outcomes, which implies more uncertainty and risk. A lower standard deviation

means that the investment has a narrower range of possible outcomes, which implies more

stability and consistency.

B. A standard deviation greater than one indicates a higher level of volatility than the

market. This statement is incorrect because the standard deviation of an investment is not

directly comparable to the standard deviation of the market, unless they have the same

mean return. The standard deviation of an investment only measures the absolute variation

of the returns, not the relative variation to the market. A better measure of the relative

volatility of an investment to the market is beta, which is the ratio of the covariance of the

investment and the market to the variance of the market.

C. Measures the systematic risk of an investment relative to a benchmark index. This

statement is incorrect because the standard deviation of an investment does not distinguish

between the systematic risk and the unsystematic risk. The systematic risk is the risk that

affects the entire market or a large segment of the market, such as inflation, interest rates,

or political events. The unsystematic risk is the risk that affects a specific investment or a

small group of investments, such as management decisions, product quality, or lawsuits.

The standard deviation of an investment captures both types of risk, whereas the beta of

an investment only captures the systematic risk.

D. Standard deviation is also referred to as beta. This statement is incorrect because

standard deviation and beta are different measures of risk. Standard deviation measures

the absolute variation of the returns of an investment, whereas beta measures the relative

variation of the returns of an investment to the market. Standard deviation is a measure of

total risk, whereas beta is a measure of systematic risk.

Question # 3

| Your clients, Philip and Helen, have a disabled son, Alex, age 22. They want to set up a

registered disability savings plan (RDSP) for Alex and have asked you for some

information.

Which statement is TRUE? |

| A. Philip and Helen's contributions are refundable to them.

| | B. There is no annual or lifetime maximum limit on contributions.

| | C. Alex must quality for the disability tax credit.

| | D. Philip and Helen's contributions are tax-deductible. |

C. Alex must quality for the disability tax credit.

Explanation: A registered disability savings plan (RDSP) is a savings plan intended to help

parents and others save for the long-term financial security of a person who is eligible for

the disability tax credit (DTC). The DTC is a non-refundable tax credit that helps persons

with disabilities or their supporting persons reduce the amount of income tax they may

have to pay. To be eligible for the DTC, a person must have a severe and prolonged

impairment in physical or mental functions, as defined by the Income Tax Act and as

certified by a medical practitioner. Therefore, Alex must qualify for the DTC in order to be

eligible for an RDSP.

Question # 4

| Salvatore and Harriet recently got married. They are presently renting but are looking

forward to buying a new home within 5 years. They both have separate savings established

in their respective registered retirement savings plans (RRSPs) of $100,000 each. They

have come to Dustin, a Dealing Representative, to open an additional joint investment

account to increase their savings to assist with their future plans of buying a new home.

What does Dustin need to ensure about his recommendation? |

| A. That the recommended investment is different from what they currently own to avoid

over-concentration.

| | B. That the risk profile for this new account is the same as what has been determined for

other accounts.

| | C. That the risk profile of the investment and each client's individual risk profile are a

match.

| | D. That the investment recommendation is based on the risk profile of the new joint

account. |

D. That the investment recommendation is based on the risk profile of the new joint

account.

Explanation: Dustin needs to ensure that his recommendation is suitable for the new joint

account, which may have a different risk profile than the individual accounts of Salvatore

and Harriet. A joint account is an account that is owned by two or more people who share

the rights and responsibilities of the account. A joint account may have different investment

objectives, time horizon, risk tolerance, and financial situation than the individual accounts

of the joint owners. Therefore, Dustin needs to conduct a know your client (KYC) process

for the joint account and determine the appropriate risk profile for the account, based on

the collective responses of Salvatore and Harriet. The risk profile of the joint account will guide Dustin in recommending suitable investment products and services that match the

goals and needs of the joint owners.

Question # 5

| What role do investment dealers play in the Canadian and global financial markets? |

| A. They are contributors to a company's profits.

| | B. They are contributors to an investor's earnings.

| | C. They assist with the exchange of capital for a financial instrument.

| | D. By underwriting financial instruments, they raise capital for investors. |

C. They assist with the exchange of capital for a financial instrument.

Explanation: Investment dealers are people or firms who buy and sell securities for their

own account, whether through a broker or otherwise. They play an important role in the Canadian and global financial markets because they are market makers, create liquidity,

and help promote long-term growth in the market. They also provide investment services to

investors, such as underwriting securities, raising capital, and offering advice. By assisting

with the exchange of capital for a financial instrument, they facilitate the flow of funds

between savers and borrowers, and between different sectors and countries. The other

options are not accurate descriptions of the role of investment dealers.

Question # 6

| Felipe is a Dealing Representative who is developing a non-registered investment solution

for Laryssa. Felipe is debating between recommending either mutual fund trusts or mutual

fund corporations. He wants to recommend an investment that reduces Laryssa's exposure

to taxation.

Which feature may influence his recommendation? |

| A. Distributions from mutual fund corporations are not taxable to investors.

| | B. Mutual fund trusts can only distribute capital gains and Canadian dividends.

| | C. Capital losses may be distributed from mutual fund corporations.

| | D. Any income received by a mutual fund corporation is distributed in the form of either

capital gains or Canadian dividends. |

D. Any income received by a mutual fund corporation is distributed in the form of either

capital gains or Canadian dividends.

Explanation: A mutual fund corporation is a type of mutual fund structure that is organized

as a corporation and issues different classes of shares to investors. A mutual fund

corporation has the ability to allocate its income and expenses among the different classes

of shares, and to distribute any income received by the corporation in the form of either

capital gains or Canadian dividends. These types of distributions are taxed at lower rates

than interest or foreign income, which may reduce the tax liability of the investors. A mutual

fund corporation can also use capital losses to offset capital gains, and carry them forward

or back to reduce taxable income in other years.

Question # 7

| Which of the following best describes how a target date fund works? |

| A. Through the years, the asset allocation shifts from equities towards fixed income as the

maturity date approaches.

| | B. Through the years, the asset allocation shifts from fixed income towards equities as the

maturity date approaches.

| | C. The mutual fund is constantly rebalanced to maintain an even split between equities and

fixed income through the life of the mutual fund.

| | D. In exchange for a lump-sum purchase the unitholder receives guaranteed monthly

payments for life. |

A. Through the years, the asset allocation shifts from equities towards fixed income as the

maturity date approaches.

Explanation: This is because a target date fund is designed to reduce the risk and volatility

of the portfolio as the investor gets closer to their retirement or other savings goal. Equities

tend to have higher returns but also higher risk than fixed income, so a target date fund

gradually reduces the exposure to equities and increases the exposure to fixed income

over time. This way, the investor can benefit from the growth potential of equities in the

early years and preserve their capital with the stability of fixed income in the later years.

Question # 8

| Jabir begins the registration process with his new dealer Prosper Wealth Inc. Jabir is

excited about his new career and eager to start calling clients, opening new accounts, and

selling investments. Which of the following CORRECTLY describes when Jabir will be

eligible to open new client accounts and sell investments? |

| A. Upon employment with the dealer

| | B. Upon registration application by the dealer

| | C. Upon passing the proficiency course

| | D. Upon formal confirmation from the regulator |

D. Upon formal confirmation from the regulator

Explanation: Jabir will be eligible to open new client accounts and sell investments only

upon formal confirmation from the regulator. Before he can start his activities as a dealing

representative, he must complete the registration process, which includes passing the

proficiency course, applying for registration through his dealer, and obtaining approval from

the securities regulator in his jurisdiction.

Get 224 Canadian Investment Funds Course Exam questions Access in less then $0.12 per day.

IFSE Institute Bundle 1:

1 Month PDF Access For All IFSE Institute Exams with Updates

$200

$800

Buy Bundle 1

IFSE Institute Bundle 2:

3 Months PDF Access For All IFSE Institute Exams with Updates

$300

$1200

Buy Bundle 2

IFSE Institute Bundle 3:

6 Months PDF Access For All IFSE Institute Exams with Updates

$450

$1800

Buy Bundle 3

IFSE Institute Bundle 4:

12 Months PDF Access For All IFSE Institute Exams with Updates

$600

$2400

Buy Bundle 4

Disclaimer: Fair Usage Policy - Daily 5 Downloads

Canadian Investment Funds Course Exam Test Dumps

Exam Code: CIFC

Exam Name: Canadian Investment Funds Course Exam

- 90 Days Free Updates

- IFSE Institute Experts Verified Answers

- Printable PDF File Format

- CIFC Exam Passing Assurance

Get 100% Real CIFC Exam Dumps With Verified Answers As Seen in the Real Exam. Canadian Investment Funds Course Exam Exam Questions are Updated Frequently and Reviewed by Industry TOP Experts for Passing Investments & Banking Exam Quickly and Hassle Free.

IFSE Institute CIFC Test Dumps

Struggling with Canadian Investment Funds Course Exam preparation? Get the edge you need! Our carefully created CIFC test dumps give you the confidence to pass the exam. We offer:

1. Up-to-date Investments & Banking practice questions: Stay current with the latest exam content.

2. PDF and test engine formats: Choose the study tools that work best for you.

3. Realistic IFSE Institute CIFC practice exam: Simulate the real exam experience and boost your readiness.

Pass your Investments & Banking exam with ease. Try our study materials today!

Official CIFC exam info is available on IFSC Institute website at https://www.ifse.ca/courselist/canadian-investment-funds-course-cifc/

Prepare your Investments & Banking exam with confidence!We provide top-quality CIFC exam dumps materials that are:

1. Accurate and up-to-date: Reflect the latest IFSE Institute exam changes and ensure you are studying the right content.

2. Comprehensive Cover all exam topics so you do not need to rely on multiple sources.

3. Convenient formats: Choose between PDF files and online Canadian Investment Funds Course Exam practice questions for easy studying on any device.

Do not waste time on unreliable CIFC practice test. Choose our proven Investments & Banking study materials and pass with flying colors. Try Dumps4free Canadian Investment Funds Course Exam 2024 material today!

Investments & Banking Exams

-

Assurance

Canadian Investment Funds Course Exam practice exam has been updated to reflect the most recent questions from the IFSE Institute CIFC Exam.

-

Demo

Try before you buy! Get a free demo of our Investments & Banking exam dumps and see the quality for yourself. Need help? Chat with our support team.

-

Validity

Our IFSE Institute CIFC PDF contains expert-verified questions and answers, ensuring you're studying the most accurate and relevant material.

-

Success

Achieve CIFC success! Our Canadian Investment Funds Course Exam exam questions give you the preparation edge.

If you have any question then contact our customer support at live chat or email us at support@dumps4free.com.

Questions People Ask About CIFC Exam

The CIFC exam is for individuals who wish to become mutual fund dealing representatives in Canada. It covers various topics related to mutual funds, including regulatory environment, types of investments, portfolio management, and making recommendations.

CIFC exam is designed for a mutual fund dealing representative, compliance professionals, branch managers, advisors, and other investment professionals who want to provide advice on mutual funds.

IFSE Institute provides a variety of study materials, including online study guides, practice exams, flashcards, and webinars. Additionally, get dumps4free CIFC dumps and prepare same exam questions at home.

|