- Email support@dumps4free.com

Topic 3: Alpine Ski House

Case study

This is a case study. Case studies are not timed separately. You can use as much

exam time as you would like to complete each case. However, there may be additional

case studies and sections on this exam. You must manage your time to ensure that you

are able to complete all questions included on this exam in the time provided.

To answer the questions included in a case study, you will need to reference information

that is provided in the case study. Case studies might contain exhibits and other resources

that provide more information about the scenario that is described in the case study. Each

question is independent of the other questions in this case study.

At the end of this case study, a review screen will appear. This screen allows you to review

your answers and to make changes before you move to the next section of the exam. After

you begin a new section, you cannot return to this section.

To start the case study

To display the first question in this case study, click the Next button. Use the buttons in the

left pane to explore the content of the case study before you answer the questions. Clicking

these buttons displays information such as business requirements, existing environment,

and problem statements. If the case study has an All Information tab, note that the

information displayed is identical to the information displayed on the subsequent tabs.

When you are ready to answer a question, click the Question button to return to the

question.

Background

Alpine Ski House has three partially owned franchises and 10 fully owned resorts

throughout the United States and Canada. Alpine Ski House’s percentage ownership of the

franchises is between two and 10 percent.

Alpine Ski House is undergoing an implementation of Dynamics 365 Finance and

Dynamics 365 Supply Chain Management to transform their financial management and

logistics capabilities across the franchises. Implementation is complete for Alpine Ski

House’s corporate offices, two US franchises, and one Canadian franchise. The remaining

franchises are in varying stages of the implementation. Two new resort projects are in the

budget planning stages and will open in the next fiscal year.

Current environment

Organization and general ledger

Each franchise is set up as a legal entity in Dynamics 365 Finance.

Alpine Ski House Corporate uses financial dimensions for their fully owned resorts.

Each resort is a financial dimension named resort.

Each fully owned resort has two divisions: marketing and operations.

Only Profit and Loss account postings require the division dimension.

Corporate handles the advertising and administration of the fully owned resorts.

Corporate uses Dynamics 365 Project Management and Accounting to manage

construction of new resorts.

Budgeting

Organizational budgeting is decentralized but rolls up to one organizational

corporate budget.

Each resort manager performs budgeting in Dynamics 365 Finance.

Budget preparation begins this month. All operational resorts will submit their

budgets in two weeks.

Sales and tax

Sales tax is configured and used by all resorts that operate in the United States.

You configure one US sales tax vendor account and assign the vendor account to

the settlement periods for reporting.

You use accounts receivable charges to track donations.

Existing purchasing contracts

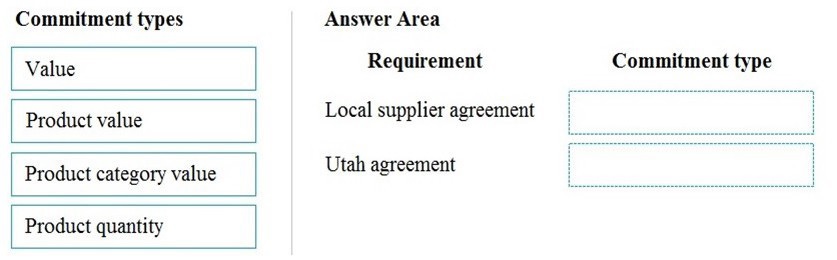

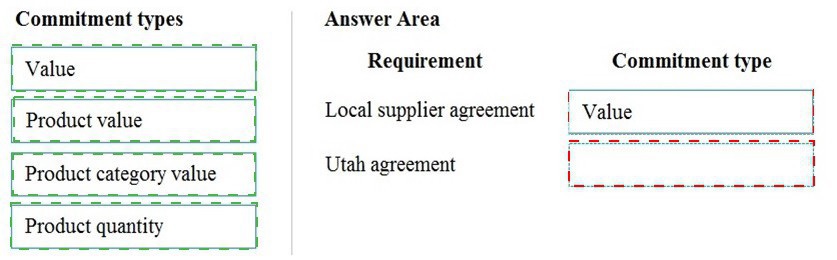

Each franchise resort has an individual contract with a local supplier of their

choosing to purchase at least $10,000 worth of suppliers during the calendar year.

The franchise resorts in one US state receive a two percent discount on meat and

vegetable purchases in excess of $8,000 per year.

A franchise resort in Utah has agreed to purchase 1,000 units of beef at market

price from a local supplier.

Alpine Ski House uses a vendor collaboration portal to track purchase orders and

requests for quotes.

Vendors request access to the vendor collaboration portal by using a workflow

which runs on a nightly schedule.

Intercompany setup

Vendor123 resides in US franchise Company1 and is set up for intercompany transactions.

Customer345 resides in Canada franchise Company1 and is set up for intercompany

transactions.

Requirements

Franchises

Each franchise must pay two percent of monthly sales to Alpine Ski House

Corporate.

Each franchise must report their own financials to Alpine Ski House Corporate

monthly.

US franchises require a three-way-match on all purchases, with a 1-percent price

tolerance.

Canadian franchises require a three-way-match on all purchases except paper

products, which have a 10-percent price tolerance.

Corporate

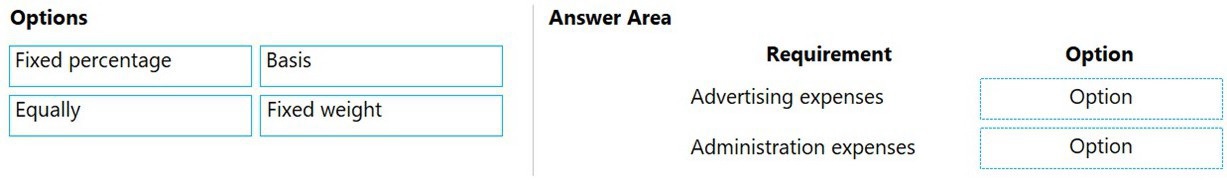

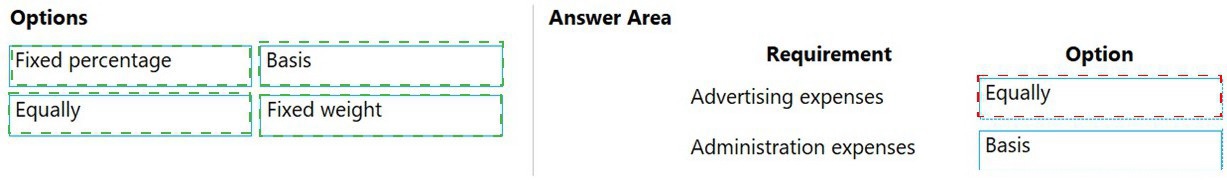

Advertising costs must be balanced across the 10 resorts monthly. These costs

must be split across the 12 resorts once construction of the final two resorts is

completed.

Administration costs must be split across the 10 resorts proportional to the amount

of sales generated.

One percent of all pack and individual ski pass sales must be donated quarterly to

an environmental protection organization.

The finance department must be able to see purchasing contracts and discounts

for vendors based on volume spend.

Employees

All employee expense reports that contain the word entertainment must be reviewed for

the audit purposes. If a journal is posted incorrectly, the entire journal and not just the

incorrect line must be fully reversed for audit purposes.

Resorts

All resorts must use Dynamics 365 Finance for budgeting and must first be approved by

the regional manager. Purchased fixed assets must automatically be acquired at product

receipt.

Issues

User1 reports that irrelevant dimensions display in the drop down when entering a

General journal.

User2 reports that dimension 00 is being used for all balance sheet accounts.

User3 tries to generate the quarterly sales tax liability payment for a specific state

but does not see any payables available for that state’s vendor.

User4 receives a call from a vendor who cannot access the vendor collaboration

portal but needs immediate access.

User5 notices a large amount of entertainment expenses being posted without an

audit review.

User6 needs to have visibility into the increase in budget that is necessary to staff

the two new resorts opening next year.

User7 needs to use Dynamics 365 Finance for situational budgeting planning with

the ability to increase and decrease the existing plans by certain percentages.

User8 made a mistake while posting a 1,000-line journal and reverses the entire

journal but cannot find the lines that included errors during the reversal.

User9 made a mistake while posting a 55-line journal and reverses the entire

journal.

User10 realizes that the purchase of five new computers did not acquire five new

fixed assets upon receipt.

You need to configure ledger allocations to meet the requirements.

What should you configure? To answer, drag the appropriate setups to the correct

requirements. Each setup may be used once, more than once, or not at all. You may need

to drag the split bar between panes or scroll to view content.

You need to configure the system to for existing purchasing contracts.

Which commitment types should you use? To answer, drag the appropriate commitment types to the correct requirements. Each commitment type may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point

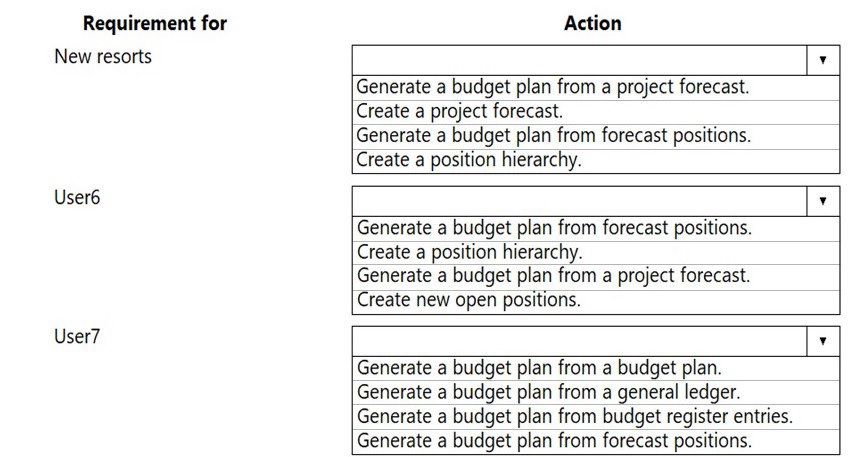

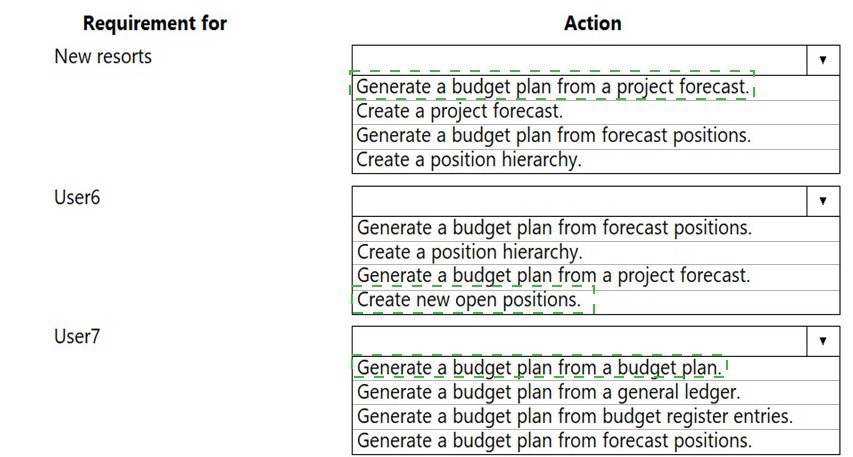

You need to configure the system to meet the budget preparation requirements.

What should you do? To answer, select the appropriate options in the answer area. NOTE: Each correct selection is worth one point.

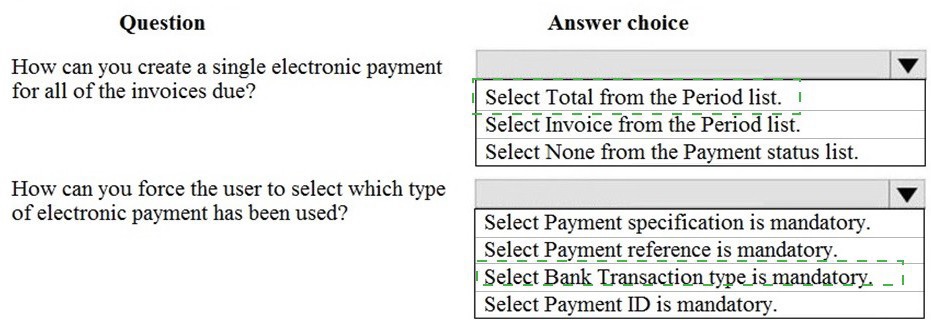

A client needs to configure Accounts payment vendor methods of payment to meet the following business requirements:

Configure the electronic method of payment to create one electronic payment for all of the invoices due. Configure the system to ensure that all payments made with an electronic method

of payment also forces the user to select which payment has been used.

You display the Methods of payment setup screen.

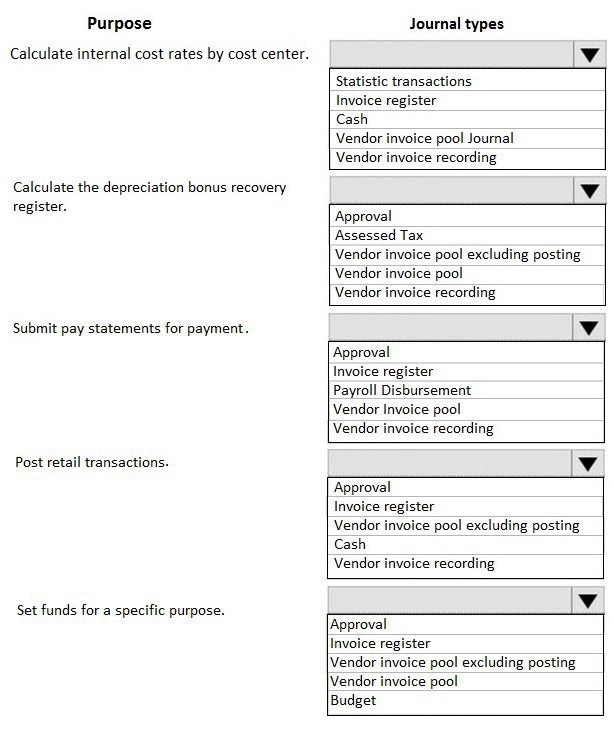

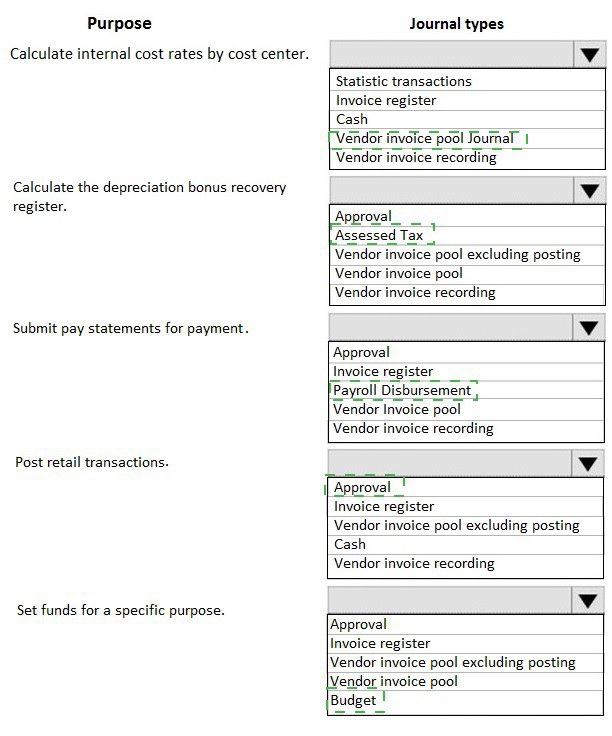

A company is using vendors to produce components for its products.

Journal types are not configured to support vendor invoices-

You need to identify and configure journals to use for vendor invoices.

Which journal types should you use? To answer, select the appropriate options in the

answer area,

NOTE: Each correct selection is worth one point

| Page 5 out of 41 Pages |

| Previous |