- Email support@dumps4free.com

Topic 2: Munson’s Pickles and Preserves Farm

This is a case study. Case studies are not timed separately. You can use as much exam

time as you would like to complete each case. However, there may be additional case

studies and sections on this exam. You must manage your time to ensure that you are able

to complete all questions included on this exam in the time provided.

To answer the questions included in a case study, you will need to reference information

that is provided in the case study. Case studies might contain exhibits and other resources

that provide more information about the scenario that is described in the case study. Each

question is independent of the other questions in this case study.

At the end of this case study, a review screen will appear. This screen allows you to review

your answers and to make changes before you move to the next section of the exam. After

you begin a new section, you cannot return to this section.

To start the case study

To display the first question in this case study, click the Next button. Use the buttons in the

left pane to explore the content of the case study before you answer the questions. Clicking

these buttons displays information such as business requirements, existing environment,

and problem statements. If the case study has an All Information tab, note that the

information displayed is identical to the information displayed on the subsequent tabs.

When you are ready to answer a question, click the Question button to return to the

question.

Background

Munson’s Pickles and Preserves Farm grows and distributes produce, jellies, and jams.

The company’s corporate headquarters is located in Dallas, TX. Munson’s has one

operations center and seven regional distribution centers in the United States.

The company has two wholly owned subsidiaries that operate in Canada. The Canadian

entity owns an entity in France.

Munson’s plans to expand into Latin America by purchasing the last 25 percent of a subsidiary that they own in Costa Rica. This process is expected to complete within the

next two years.

The company plans to implement Dynamics 365 Finance and Dynamics 365 Supply Chain

to meet their growing business needs.

Current environment. General

Munson’s uses a mix of internally-developed legacy systems that handle their finance and

distribution activities. The company has an isolated CRM system.

Both Canadian subsidiaries have two departments: marketing and operations.

Financial reporting is difficult due to data residing in disparate systems.

Financial reporting is currently performed by using Microsoft Excel.

Pre-orders in the current system are difficult to track because the order

management system is not integrated with the finance system.

Pickle sales post to one revenue account, but this does not allow for targeted

reporting by pickle cut and type.

Current environment. Organization

The following chart shows Accounting/Reporting Currencies and Tax ID, if applicable.

Typically, vendor invoices are received prior to receipt of product.

The following fixed assets are sold for a loss:

BUILD-100

CAR-1233

At the regional distribution centers, the value for physical inventory does not match

the inventory in the financial system.

Munson’s rents their corporate office. Rent is not paid by purchase order. Rent is

due once a quarter.

Allocations are performed manually.

Barrels are inventoried by site and warehouse.

Munson’s has multiple depreciation and tax books for all of their fixed asset

equipment.

Budgets are posted at the department level for each legal entity.

Requirements. Sales

Customers should be able to pre-order for fall release of pickles.

Three-way matching must be enforced for all purchases.

Fixed asset sale transactions require a ledger account entered at the time of

transaction.

Fixed assets purchased must be automatically created in fixed asset module. This

includes inventory items and write in purchase orders/non-inventoried items.

One dollar from every sale needs must be tracked and donated at the end of each

month to a charitable organization.

Purchasing budgets must be enforced at the main account level.

Requirements. Finance

Accounts payable must be able to enter vendor invoices on the day they were

received to be settled against when product is received.

Accounts payable must be able to enter vendor invoices to accrue expense

without specifying a purchase order at the time of entry.

Postage expenses must be split evenly across the regional distribution centers

automatically.

Administrative expenses must be distributed across the regional distribution

centers by percentage of fulfillment orders monthly.

Pickling machines depreciation must be uniquely recorded for visibility but not post

to the ledger.

Issues

During implementation testing, User1 indicates that after packing slips are

generated for purchase orders, there are no ledger postings.

User2 indicates that fixed assets purchased on a purchase order do not show up

in the Fixed Assets module.

User3 reports that they are seeing inconsistent application of the one-dollar

donation from all sales orders.

User4 in the Canadian subsidiary is able to purchase supplies for marketing

despite exceeding the marketing department budget.

User5 reports that when purchasing a non-inventoried computer, the system is

automatically assigning it to the buildings fixed asset group.

You need to configure system functionality for pickle type reporting.

What should you use?

A.

item model groups

B.

item groups

C.

procurement category hierarchies

D.

financial dimensions

E.

procurement categories

item groups

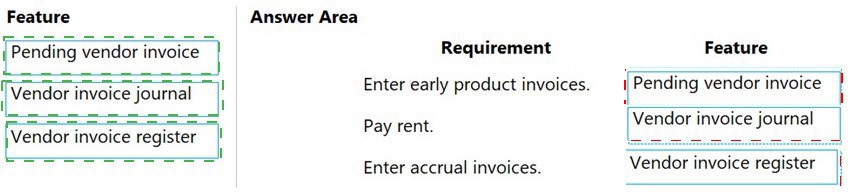

You need to configure the system to meet invoicing requirement.

Which features should you use? To answer, drag the appropriate features to the correct

requirements. Each feature may be used once, more than once, or not at all. You may

need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You need to prevent the issue from reoccurring for User5.

What should you do?

A.

Use the audit list search query type.

B.

Set up the aggregate query type for entertainment expenses.

C.

Set up the sampling query type for entertainment expenses.

D.

Add more keywords to the audit policy.

Add more keywords to the audit policy.

The Canadian franchise purchases excess ski equipment from the US franchise. Two sets of skis are purchased totaling USD1,000.

When the purchase invoice is prepared, USD10,000 is keyed in by mistake.

Which configuration determines the result for this intercompany trade scenario?

A.

Post invoices with discrepancies is set to require approval.

B.

Match invoice totals is set to yes.

C.

Three-way match policy is configured.

D.

Two-way match policy is configured.

E.

Post invoices with discrepancies is set to allow with warning.

Three-way match policy is configured.

You need to adjust the sales tax configuration to resolve the issue for User3.

What should you do?

A.

Create multiple settlement periods and assign them to the US tax vendor.

B.

Create multiple sales tax remittance vendors and assign them to the settlement period.

C.

Run the payment proposal to generate the sales tax liability payments.

D.

Create a state-specific settlement period and assign the US tax vendor to the settlement

period.

Create a state-specific settlement period and assign the US tax vendor to the settlement

period.

| Page 4 out of 41 Pages |

| Previous |