- Email support@dumps4free.com

Topic 1: Fourth Coffee Case Study

Case study

This is a case study. Case studies are not timed separately. You can use as much exam

time as you would like to complete each case. However, there may be additional case

studies and sections on this exam. You must manage your time to ensure that you are able

to complete all questions included on this exam in the time provided.

To answer the questions included in a case study, you will need to reference information

that is provided in the case study. Case studies might contain exhibits and other resources

that provide more information about the scenario that is described in the case study. Each

question is independent of the other questions in this case study.

At the end of this case study, a review screen will appear. This screen allows you to review

your answers and to make changes before you move to the next section of the exam. After

you begin a new section, you cannot return to this section.

To start the case study

To display the first question in this case study, click the Next button. Use the buttons in the

left pane to explore the content of the case study before you answer the questions. Clicking

these buttons displays information such as business requirements, existing environment,

and problem statements. If the case study has an All Information tab, note that the

information displayed is identical to the information displayed on the subsequent tabs.

When you are ready to answer a question, click the Question button to return to the

question.

Background

Fourth Coffee is a coffee and supplies manufacturer based in Seattle. The company

recently purchased CompanyA, based in the United States, and CompanyB, based in

Canada, in order to increase production of their award-winning espresso machine and

distribution of their dark roast coffee beans, respectively.

Fourth Coffee has set up CompanyA and CompanyB in their Dynamics 365 Finance

environment to gain better visibility into the companies' profitability. CompanyA and

CompanyB will continue to operate as subsidiaries of Fourth Coffee, but all operational

companies will be consolidated under Fourth Coffee Holding Company in US dollars (USD)

for reporting purposes.

The current organizational chart is shown below:

You need to correct the sales tax setup to resolve User5's issue.

Which three actions should you perform? Each correct answer presents part of the solution.NOTE: Each correct selection is worth one point.

A.

Populate the sales tax code on the sales order line.

B.

Assign the sales tax group to CustomerY.

C.

Assign the relevant sales tax code to both the sales tax and item sales tax groups.

D.

Populate the item sales tax group field on the sales order line.

E.

Populate the sales tax group field on the sales order line.

Assign the relevant sales tax code to both the sales tax and item sales tax groups.

Populate the item sales tax group field on the sales order line.

Populate the sales tax group field on the sales order line.

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/indirect-taxesoverview

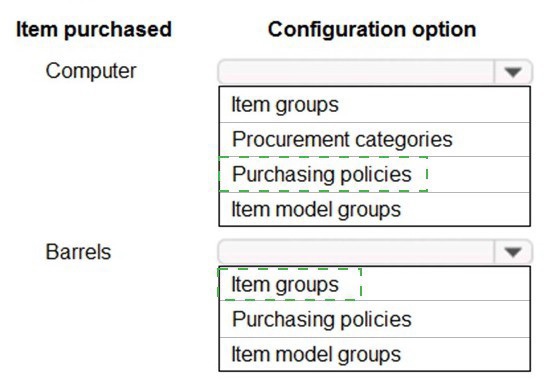

You need to determine the root cause for User1’s issue.

Which configuration options should you check? To answer, select the appropriate options

in the answer area.

NOTE: Each correct selection is worth one point

You need to recommend a solution to prevent User3's issue from recurring.

What should you recommend?

A.

Configure automatic charge codes.

B.

Create a service item.

C.

Configure a sales order template.

D.

Create a procurement category.

D18912E1457D5D1DDCBD40AB3BF70D5D

Configure automatic charge codes.

You need to identify the root cause for the error that User5 is experiencing.

What should you check?

A.

Fixed asset rules

B.

Fixed asset determination rules

C.

Fixed asset posting profiles

D.

Fixed asset books

E.

Fixed asset depreciation profiles

Fixed asset determination rules

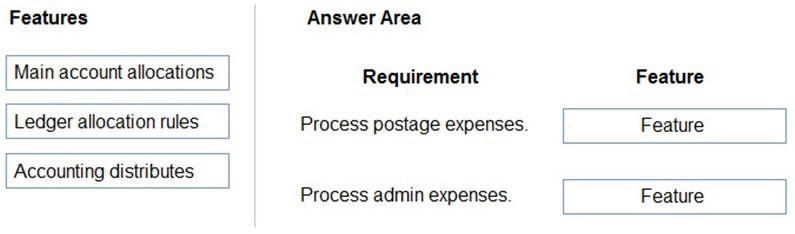

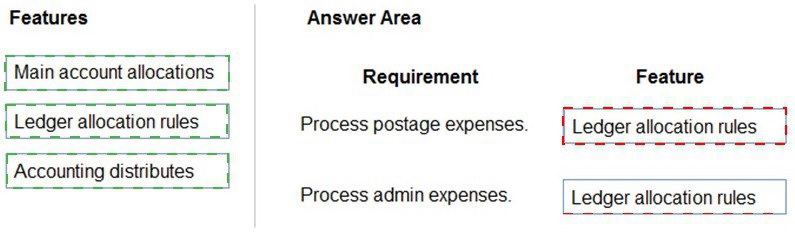

You need to process expense allocations.

Which features should you use? To answer, drag the appropriate features to the correct

requirements. Each feature may be used once, more than once, or net at all. You may

need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

| Page 3 out of 41 Pages |

| Previous |